It's no secret that the road to homeownership is an expensive – albeit rewarding – one. Between mortgage payments and renovations, homeowners may feel their budgets stretched thin. There is hope, however: renting out your spare space.

The search term "renting your home" yields over 180 million search results on Google, so homeowners are certainly interested in this form of cost mitigation. Wanting to know more, we surveyed 950 people who own a home. We learned which spaces homeowners are renting out, how much money they're making, and even dove into some of their biggest regrets. Continue reading to see just how rewarding or frustrating in-home rental units can be.

Reasons to Rent

Many homeowners may have dreamt of running a beautiful bed-and-breakfast or even finding a best friend in a roommate, but money – not memories – was the primary factor behind renting our their spaces. Nearly 74% of homeowners said they rented out their properties "to make extra money." Another 33.3% said the rent money helped them to pay their mortgage, 22.4% used the extra funds to cover property taxes, and 18.6% put their renters' money toward utilities.

If you do happen to be in the market for a rental unit, a bedroom will probably be your base requirement. Forty-three percent of homeowners chose to rent out an extra bedroom or two. Twenty-seven percent, however, rented with slightly more separation between the tenant and landlord, offering a finished basement as the rental unit. For the most luxurious of stays, 16.6% rented out a detached guesthouse.

First Impression Fixes

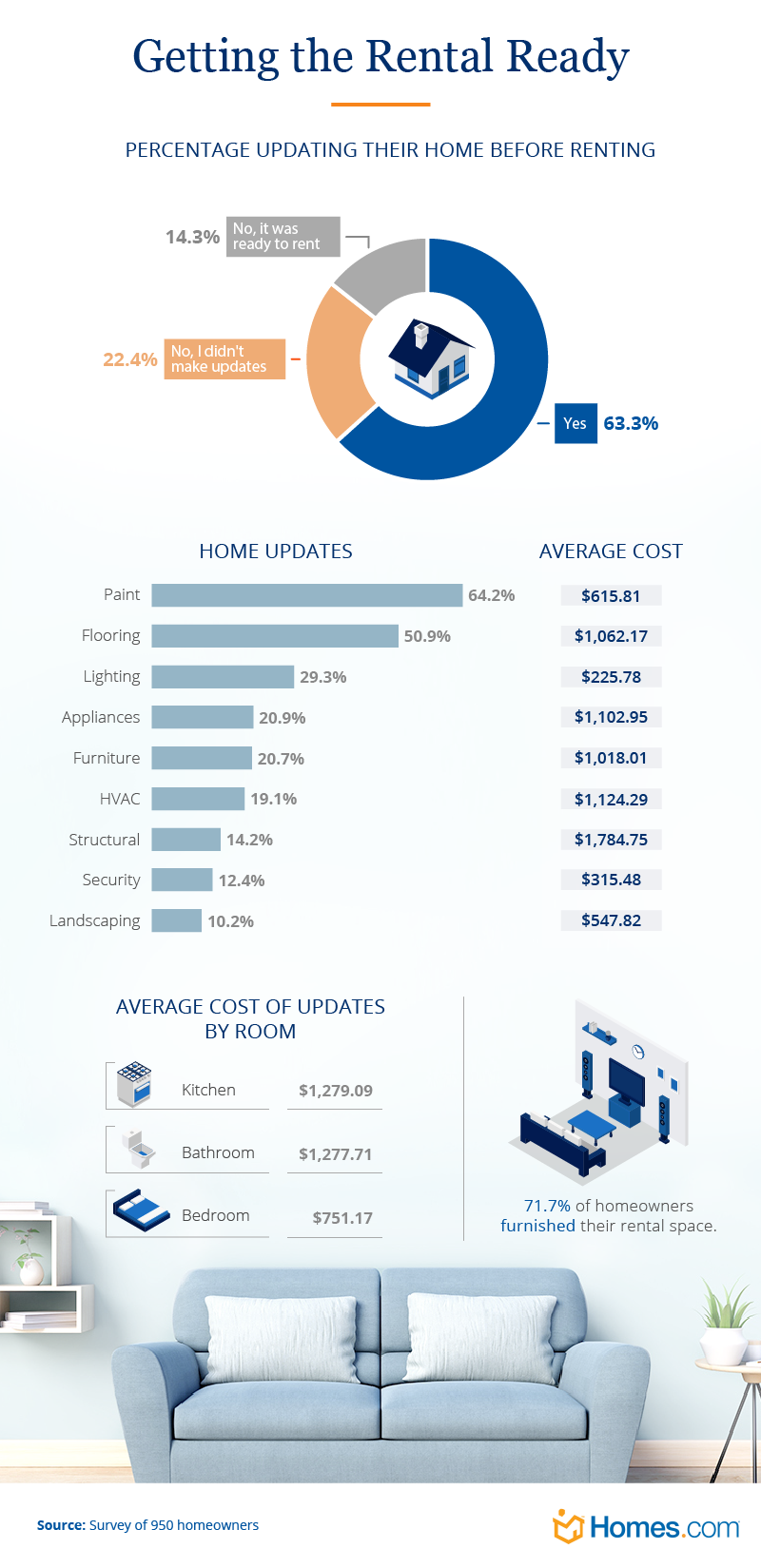

Unless homeowners were part of the lucky 14.3% who didn't need to do any renovations prior to their tenant's arrival, they tended to face one update or another. In certain situations, the landlord may be required to apply a fresh coat of paint before the move in, but freshly painted walls are often necessary to make the rental ready to show in the first place. On average, our respondents spent $615.81 on paint, which was also the most common update completed for renters. The flooring was also updated more than half of the time, but new floors ran an average tab of nearly twice the amount of the paint!

Unless homeowners were part of the lucky 14.3% who didn't need to do any renovations prior to their tenant's arrival, they tended to face one update or another. In certain situations, the landlord may be required to apply a fresh coat of paint before the move in, but freshly painted walls are often necessary to make the rental ready to show in the first place. On average, our respondents spent $615.81 on paint, which was also the most common update completed for renters. The flooring was also updated more than half of the time, but new floors ran an average tab of nearly twice the amount of the paint!

Although not many respondents updated their furniture, 71.7% chose to furnish their rental units. From the renter's perspective, a pre-furnished unit can present a money-saving opportunity, as well as help to avoid a potential headache when moving in or out. When homeowners from this study did decide to update their rentals, however, they spent the most money on their kitchens, with an average renovation tab of $1,279.

Renter Resumes

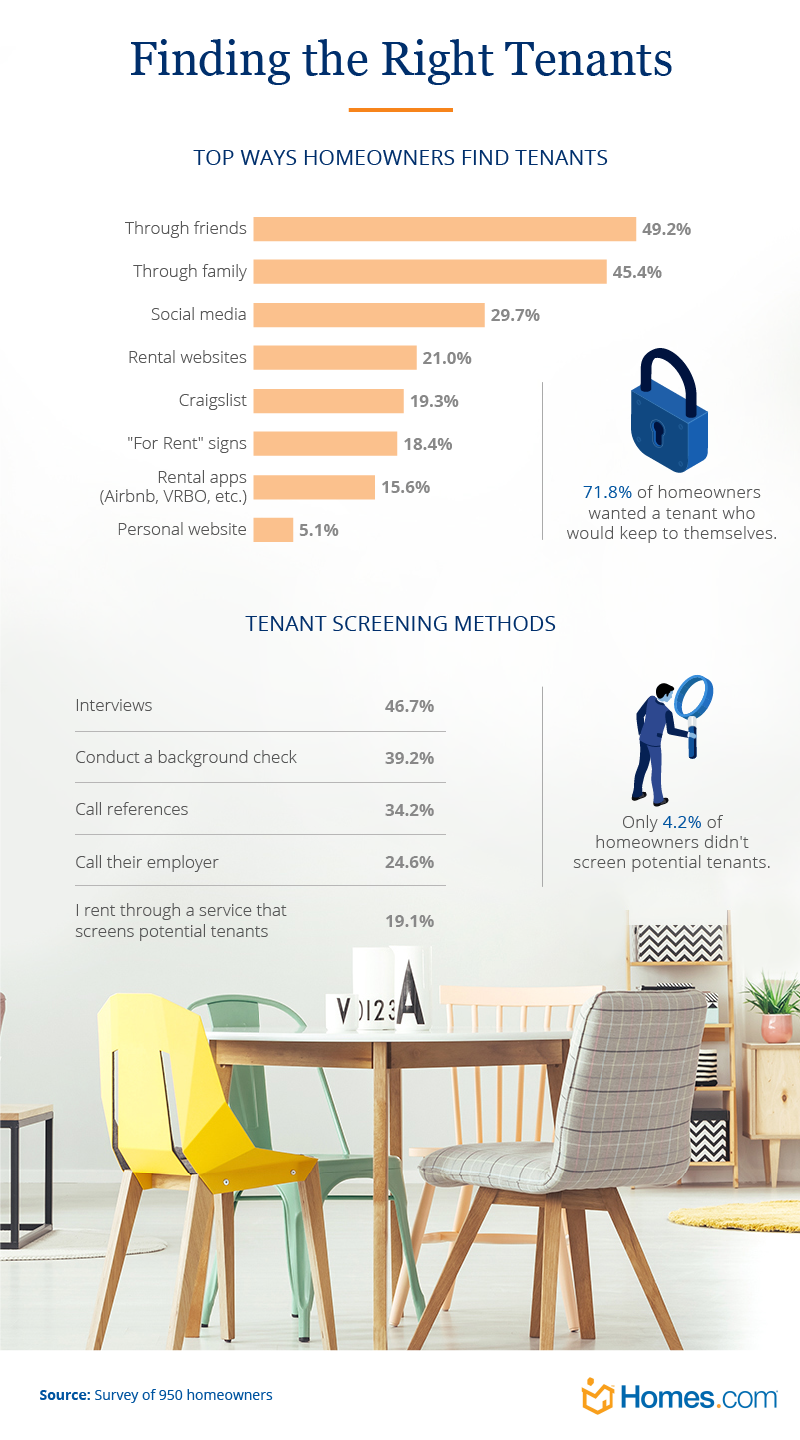

Despite the massive explosion of rentals sites like Airbnb and Vrbo, most homeowners didn't rent out their spaces this way. Of the 711 homeowners who rent out their space, the most common way to find tenants was through friends. Forty-nine percent of respondents found tenants this way, followed by 45.4% who connected with tenants through family.

Landlords may be reluctant to let a stranger use their linens, or maybe they worry about a potential security threat. Fortunately, 95.8% of respondentsdid screen prospective tenants one way or another. Almost 47% interviewed the candidate, while 39% went a step further and conducted a background check. Of course, some homeowners would love a tenant who passes a background check or with whom they hit it off during the interview, but most often, respondents wanted their tenants to keep to themselves.

Rent Is Due

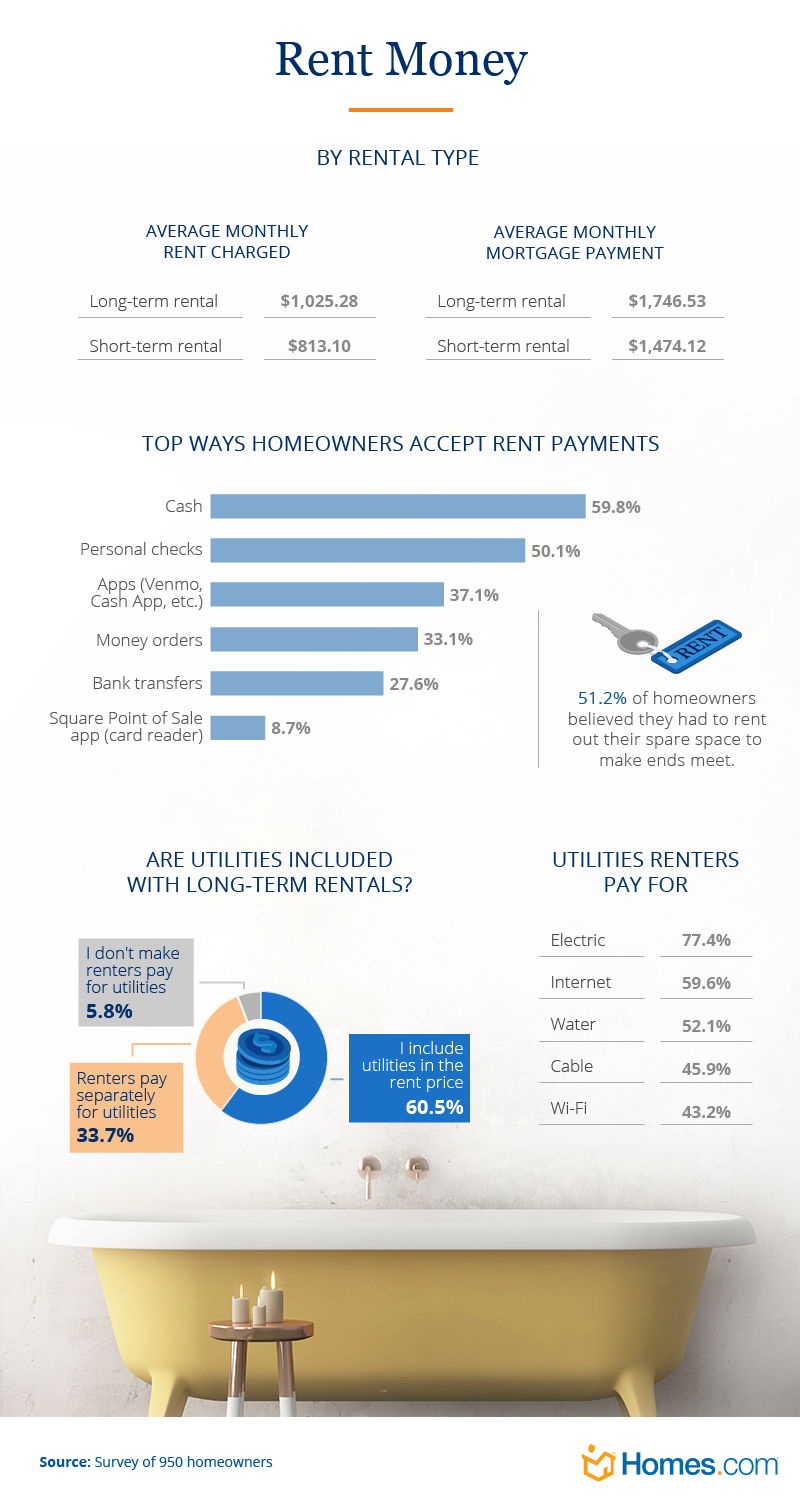

So what returns did our respondents see in exchange for renting out their homes? Between $800 and $1,030 each month, depending on the rental terms. Shorter-term rentals brought in numbers on the lower end of the spectrum, whereas long-term rentals helped homeowners contribute more to their monthly mortgage. Although there is typically a premium monthly rate charged for short-term rentals, these numbers may reflect the overall success of various rental types. If rentals are shorter, it may mean less guaranteed funds each month as tenants move in and out. Longer-term contracts, however, may provide a more consistent income stream, possibly resulting in higher average monthly earnings.

The most common way homeowners accepted rent from their tenants was in the form of cash (59.8%). Unless your rental unit is extremely inexpensive, though, rent can be a large and risky sum to carry in cash, so 50.1% also accepted personal checks. Innovative forms of payment, however, are becoming increasingly popular. Apps such as Venmo were used by more than a third of homeowners to accept payment. Having this type of flexibility may be appealing to many renters, so consider this option if you're looking to increase the desirability of your own rental.

What Could Go Wrong?

If you have space and need the money, renting may seem like a no-brainer, especially when you consider that 80.5% of respondents reported a positive experience when renting out their homes. Nevertheless, that doesn't mean homeowners didn't learn a lesson or two. Less than one in 4 respondents expressed some regrets with their tenants and rental experiences.

The biggest regret was not having charged more for rent. On average, homeownership costs Americans $9,400 in "hidden" costs, so the rent initially needed may end up not being enough. Another 17.6% expressed regret in not screening their tenants more intensively. Nearly the same amount also wished they had installed better security. These safety and background concerns actually stopped 31% of homeowners, who expressed they hadn't rented out their spaces yet because of safety concerns. Lastly, just 5.2% said they wished they had never opened their homes to renters in the first place.

Home Sweet Home

Whether you're a tenant or landlord, safety is just one of many concerns. Proximity to work and schools, amenities, and real estate market trends may dictate where you ultimately decide to call home. Fortunately, all of the concerns and desires that come with homeownership are readily prioritized and filtered through Homes.com.

Simply put, Homes.com offers a smarter home search. Search by any location, then modify and refine your criteria when you know more about what you're looking for. And if you find a dream home with price that happens to be out of reach, you just might want to consider renting out extra space, as so many homeowners across the U.S. are already beginning to do.

Methodology and Limitations

To collect the data shown above, we conducted a survey of 950 respondents. To qualify for this survey, respondents were required to own their homes. Of the 950 respondents, 433 had a long-term rental, 278 had a short-term rental, and 239 thought about renting out their spare space. The respondent pool was 52.5% men and 47.5% women. The data were calculated to exclude outliers. We did this by finding initial averages and standard deviations for the data. Then, the standard deviation was multiplied by two and added to the initial average. Any data point above the calculated number was then excluded from the data. Because the survey relies on self-reporting, issues such as telescoping and exaggeration can influence responses. An attention-check question was included in the survey to make sure respondents did not randomly answer.

Fair Use Statement

Have some rental experience of your own or know someone who may benefit from our results? You're more than welcome to share this article and its findings, so long as it's for noncommercial purposes and you are sure to link back to this page.